What Does a Tax Preparer Do? A Simple Guide

Tax preparation services often overlap with those of other accounting professionals. However, their primary role remains in preparing tax returns for individuals and organisations. These professionals’ key roles revolve around navigating the taxing system’s complexities, mitigating compliance issues, and helping individuals maximise tax savings.

These professionals are independent employees or contractors within an organisation. Their key responsibilities include establishing collaborations with other key financing and accounting professionals and individuals. Their expertise and experience in their defined roles allow them to advance their career further into consulting and managerial roles.

In this guide, let us understand what a tax preparer does, eligibility, and the importance of tax preparer training.

What Do They Do to Save Your Taxes?

Most tax preparation services prepare, file and assist individuals in submitting their general tax forms. These services are their basic responsibilities. Apart from these responsibilities, they also defend your financial payslips with the IRS. These issues also include all such matters related to audits and tax courts. However, the tax preparer’s credentials determine to what extent they can accomplish their roles and responsibilities.

In short, they serve on both sides — their clients as well as the IRS. They should assist their clients in complying with the necessary codes set by the state and federal systems. At the same time, they should also minimise the load on their clients. When they are hired, they should strictly abide by the IRS obligations by denying support to any false claims or filings.

What Are the Duties of a Tax Preparer?

The key duty of tax preparers is to file tax returns for individuals and organisations. They are responsible for ensuring that each client’s return meets the requirements set by the state and federal governments.

Below is the list of critical duties of a tax preparer:

Collecting Clients’ Valid Information

Your tax preparer will ask you for all your financial documents to develop an understanding of your financial situation. They also review how accurate your documents are before filing a return.

Review Earlier Returns

These professionals will next review your previous returns for any possible errors, thereby ensuring that you are complying with their submission requirements.

Streamlines Tax Process by Using Tax Software

Your tax preparers use software to automate their calculations and record-keeping. It makes their life easier through comparisons of complex scenarios to avoid basic errors related to data entries.

How Can You Become a Tax Preparer?

There is no critical educational requirement to become a tax preparer in India. All you need is a basic graduation degree from any recognised Indian university in either management, business administration, law, economics, or mathematics. Plus, you can undergo a tax preparer training with a key focus on:

Know-Hows

Mostly, tax preparers learn the basic ins and outs of the businesses they collaborate with. In some scenarios, you will have to opt for specific certifications. Hunt for a professional grade and industry-oriented certification program online to boost your know-how and assist you with the required knowledge gaps as and when needed.

Technology

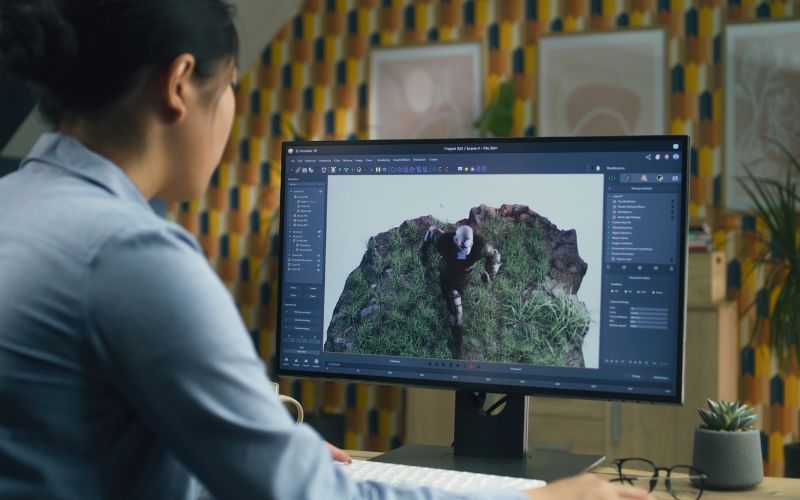

In most professions, technology supports you and helps you work more efficiently on your assignments. Most professionals use AI-powered software to manage daily tasks and enable them.

Clients

Last but not least, you need clients to deal with. Your clients are the base for your success and career growth. Many tax preparers start small with individual returns before they scale up their career ladder. With the increase in their knowledge, they receive more opportunities from their clients.

Benefits of Enrolling on a Tax Preparer Training Course in India

If you are aspiring to become a tax preparer service provider someday, here are some of the key benefits of enrolling in the training programs available in Kolkata:

Enhancing Career Opportunities

A tax course opens up a broader range of career options before you in the finance, accounting and legal domains. You can be a tax accountant, tax advisor, tax manager, tax consultant, and tax analyst.

Gaining Practical Knowledge

A degree in accounting principles helps you gain theoretical knowledge while focusing on real-world scenarios.

Specific Skill Development

You learn special skills such as GST, tax filing, international transactions, and income tax.

Gaining Competitive Edge

The market is ever-evolving. Thorough expertise in taxation is a prerequisite today. With the proper course knowledge and digital proficiency, you will always be attractive to lucrative job profiles.

Networking Opportunities

Connecting with India’s best tax preparer training institutes opens up broader networking opportunities for connecting with like-minded professionals. You can then participate in focused group discussions, forums, and related webinars to further enhance your knowledge and skill set.

Conclusion

Tax preparation services are essential today for handling complex financial problems by significantly reducing tax uncertainties. As a tax preparer, your job will focus more on identifying potential issues that will likely arise for your clients and their businesses. You will be the centre of attraction for offering functional and unbiased advice to resolve any business complications.

India has a popular tax preparer training institute called the George Telegraph Institute of Accounts (GTIA), imparting certificate courses on Advanced Diploma in Professional Business Accountant, Diploma in Executive Business Accountant, and certification course on Goods & Service Tax. These are the essential courses to build your skill set for the roles you must execute as a tax preparer in India. Besides, they also offer certification courses in Tally Prime and advanced courses in Microsoft Office to polish your presentation skills. Contact GTIA’s team today to understand which course you should go ahead with.